Below are all of the settings in store setup along with their descriptions, these same descriptions are displayed on the screen when you click on an item in the setting list.

You can use the search feature to search for keywords on this page (CTRL-F).

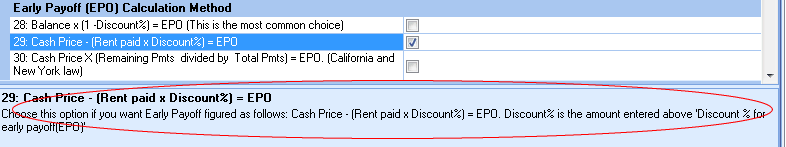

The image below shows how the description (circled in red at the bottom) is displayed when a setting is selected.

Store Setup / Main Tab

1: Company Name

Company Name is saved when you register RTO Pro.

2: Company DBA Name

DBA name is saved when you register RTO Pro.

3: Store Address

4: City, ST Zip

If you want the state filled in automatically when adding customers enter like follows: EUSTIS, FL 32726 If you do not want the state filled in automatically for new customers do not put a comma after city like this: EUSTIS FL 32726

5: Store Phone#

6: Store E-mail address

Fill in your stores Email address here.

7: Store # 1-98

This is for what store # your store is (For companies with multiple stores each store must have a unique store number)

9: Use Zones or Routes to split customers into groups

Check this if you want to be able to split your customers into groups for different account managers etc.

10: If you use Customer Zones to split customers into groups check this box if you want to be able to enter descriptions of the zones (city, state) instead of just entering a number.

Check this if you want to be able to enter descriptions of the zone/route numbers and be able to select from a list of zones.

11: This store is in CANADA

Check this if your store is in Canada to enable Canada specific options.

12: This store is in Maine

Check this if your store is in Maine to enable Maine specific options (Right to Cure and 5 Day Demand Letters in OSAM).

13: This store sends data to a RTO Pro Home Office

Check this if you have a Home Office that uses RTO Pro Home Office

14: Allow customers to pay 'Deposits' AKA 'Suspense'

Check this if you want to be able to accept Deposits (sometimes called suspense) along with payments and on new rentals.

15: For partial payments move due date the full term and track Back Rent Due

Check this if you want to move due dates the full term (Week, Month etc.) when partial payments are paid. Back Rent Due would be tracked and can be collected in future payments.

16: Directory for Data Files

This is the directory that stores the data files for the entire network. Click on the Setup Data Path button to setup Server information.

17: Enter description for Custom Payment Form 1

You can have 3 custom payment forms for example 'PAY PAL' could be a custom payment form. Enter the description for 1st custom payment form here.

18: Enter description for Custom Payment Form 2

You can have 3 custom payment forms for example 'PAY PAL' could be a custom payment form. Enter the description for 2nd custom payment form here.

19: Enter description for Custom Payment Form 3

You can have 3 custom payment forms for example 'PAY PAL' could be a custom payment form. Enter the description for 2nd custom payment form here.

20: Discount % for early payoff(EPO)

Discount % for early payoff(EPO) for Rent to Own Example for 45% discount enter .45

If your payoff calculation method is 'Cash Price - (Rent paid x Discount%) = EPO' this is the percentage of rent that comes off cash price.

21: Set Discount on individual contract basis

Check this if you want to be able to enter different discount amounts for each contract.

22: Do NOT allow discount for EPO in the final ? months

For example if you enter 2 here, anybody who has 2 months or less remaining will not get a discount for early payoff.

23: Only allow discount for EPO in the first ? months

If you only offer a discount for early payoff in the first set number of payments enter that number here. This option or the option above can be used, THEY CAN'T BOTH BE USED.

24: For final months Calculate by Contract Date instead of just remaining Payments.

Check this if you want to calculate the final months by the contract date instead of actual payments remaining. That way if a customers due date is moved it will not extend their EPO time period.

25: When calculating Payoff give discount on future pre-paid payments also.

Check this if you want to give discount on pre-paid future payments also. Example: If a customer has $500 balance and you give a 40% discount and they are paid ahead 2 full months at 50.00 a month. With this box checked payoff=$260.00(500+100 x .6 - 100), without it checked payoff=$300.00(500 x .6). For RTO contracts only and this does not apply to the California method of calculating EPO.

26: Balance x (1 -Discount%) = EPO (This is the most common choice)

Choose this option if you want Early Payoff figured as follows: Balance x (1 -Discount%) = EPO. Discount% is the amount entered above 'Discount % for early payoff(EPO)'

27: Cash Price - (Rent paid x Discount%) = EPO

Choose this option if you want Early Payoff figured as follows: Cash Price - (Rent paid x Discount%) = EPO. Discount% is the amount entered above 'Discount % for early payoff(EPO)'

28: Cash Price X (Remaining Pmts divided by Total Pmts) = EPO. (California and New York law)

Choose this option if you want Early Payoff figured as follows: Cash Price X (Remaining Pmts divided by Total Pmts) = EPO. (California and New York law)

29: R - Rent to Own

Check this if you want to allow Rent to Own agreements to be loaded.

30: T - Rent to Rent

Check this if you want to allow Rent to Rent or short term rental agreements to be loaded.

31: L - Lease to Own

Check this if you want to allow Lease to Own agreements to be loaded (Either Federal Lease agreements or a Lease Agreement with no discount for early payoff).

32: G - As Agent

Check this if you want to allow G As Agent type agreements to be loaded. An As Agent type agreement can be used in cases where you need revenue seperated from other revenue. Revenue from G agreements will be seperated on revenue reports. There is NO EARLY PAYOFF DISCOUNT AUTOMATICALLY CALCULATED FOR THIS CONTRACT TYPE.

33: O - Other Type Agreement

Check this if you want to allow Other type agreements to be loaded. An Other type agreement can be used in cases where you need revenue seperated from other revenue. Revenue from O agreements will be seperated on revenue reports. There is NO EARLY PAYOFF DISCOUNT AUTOMATICALLY CALCULATED FOR THIS CONTRACT TYPE.

34: For 'O' type contracts calculate Early Payoff same as RTO.

Check this if you want to the EPO for Other type agreements to be calculated the same as RTO agreements.

35: Outgoing SMTP Server address

Enter the Outgoing SMTP Server address for your email provider. Contact your email service provider for this info.

36: Email Sender Name / Store Name

When you send email there is generally a name with the "From" email address, for instance "(RTO Pro Software)Sales@rtopro.com". Enter the name here you want associated with your email address.

37: Stores Email Address

When you send email this would be the address the reply would go to if the receiver sends you a reply.

38: SMTP User Name (if required)

User name for your outgoing SMTP account, if required. Contact your email service provider for this info.

39: SMTP Password (if required)

Password for your outgoing SMTP account, if required. Contact your email service provider for this info.

40: Send using SSL (secure sockets layer)(if required)

If your email provider requires email to be sent using SSL check this box. Contact your email service provider for this info.

41: Outgoing Email Port (if required)

Outgoing Email port for your outgoing SMTP account, if required. Contact your email service provider for this info.

42: Click the button here to reset RTO Pro screen position to TOP, Left

Click here if you want RTO Pro to be positioned to the top left of the screen.

43: Do not display popups on startup

Popups are the little messages that pop up on the lower right of the screen on startup the first time RTO Pro is ran each day.

44: Hide the Task Panel (NOT recommended, collection actions are viewed in the task panel).

Check this box to Hide the Task Panel. This is NOT recommended because collection actions are displayed in the task panel.

45: Select a Visual Theme for the RTO Pro Task Panel

Use the drop down list to select the visual theme for the Task Panel (Its on the right side of the screen if your screen resolution is high enough)

46: Select a Behavior for the RTO Pro Task Panel

Use the drop down list to select the behavior for the Task Panel (Its on the right or left side of the screen if your screen resolution is high enough)

47: Put the Taskbar on the left instead of the right side.

48: Optional enter any title you want displayed in the task bar and status bar.

Anything you enter here will be displayed in the taskbar and the statusbar in RTO Pro. This is mainly used to help differentiate between companies when you run several companies with RTO Pro from the same computer.

49: Optional enter any message you want displayed on the Point of Sale Menu.

Anything you enter here will be displayed at the bottom of the Point of Sale menu, it can be any message, reminder etc (255 characters max).

50: Verify the Firebird Service is running each time you run RTO Pro. This only needs to be checked when instructed by tech support.

If you check this box a routine will be ran to verify the Firebird service (the database for RTO Pro) is running every time you start RTO Pro.

51: ColorTyme Store ID... ONLY IF THIS IS A COLORTYME STORE.

If this store is a ColorTyme Store enter the ColorTyme Store ID here. ... ONLY IF THIS IS A COLORTYME STORE.

52: ColorTyme Lifecycle Store ID... ONLY IF THIS IS A COLORTYME STORE.

If this store is a ColorTyme Store enter the Lifecycle Store ID if this store participates in the Lifecycle program. ... ONLY IF THIS IS A COLORTYME STORE.

Sales Tax Tab

1: Enter the initials or abreviation to use for your tax

Set this to the initials for TAX in your area.

2: Enter your default tax rate (for 6% enter .06)

Default Tax Rate for your store (Note for 6% enter .06)

3: This store has a different default tax rate for Retail Sales

Check this box if your store has a different tax rate for retail sales than the normal tax rate.

4: Enter your default RETAIL SALE tax rate (for 6% enter .06)

Default RETAIL SALE Tax Rate for your store (Note for 6% enter .06)

5: Click the button on this line to change Tax Rate on existing contracts

This is to change tax rate on existing contracts, changing the default tax rate in setup will not affect existing contract, use this function to change existing contracts.

6: Enter tax rate for NSF fees (for 6% enter .06)

Enter tax rate for NSF fees (usually 0)

7: Enter tax rate for Check Cashing fees(for 6% enter .06)

Enter tax rate for Check Cashing fees (for 6% enter .06)

8: Use Tax Zones (for destination based tax states)

Check this box if your store is in a destination based tax state, where the tax is based on where the customer lives.

9: Click the button on this line to edit Tax Zones

This is to edit Tax Zones if you are in a destination based tax state

10: PST Tax Rate (Canada)(for 6% enter .06)

Enter the PST Tax Rate here, for Canada(Note for 6% enter .06)

11: GST Tax Rate (Canada)(for 6% enter .06)

Enter the GST Tax Rate here, for Canada(Note for 6% enter .06)

12: Other Charges are NOT TAXABLE

Check this box if Other charges such as late fees are NOT TAXABLE

13: Delivery Charges on new Rental Agreements are NOT TAXABLE

NOTE: This setting only works if you are NOT using Tax Zones(Destination based tax). Check this box if Delivery charges on rental agreements are NOT TAXABLE. The only affects delivery fees paid with a down payment when agreement loaded.

14: Processing Fees on new Rental Agreements are NOT TAXABLE

NOTE: This setting only works if you are NOT using Tax Zones(Destination based tax). Check this box if Processing Fee on rental agreements are NOT TAXABLE. The only affects delivery fees paid with a down payment when agreement loaded.

15: DWF/LDW/GRP (Damage Waiver) fees are NOT TAXABLE

Check this box if DWF/LDW/GRP (Damage Waiver Fees) are NOT TAXABLE

16: Club fees are NOT TAXABLE

Check this box if Club are NOT TAXABLE. NOTE: Club is generally taxable in every state.

17: By Default treat open sales as Account Receivables

When an open sale is treated as A.R.(Accounts Receivable) the tax and sale amount are counted on the books when sold and the balance is treated as Accounts Receivable. When not treated like A.R. it is handled much like a rental where income is counted when paid.

18: Do not allow change from AR sale handling choice above.

If this box is checked you will not be able to change the from the default handling of open sales that you choose above.

Late Fees Tab

1: Charge every contract a late fee if customer has multiple contracts

Check this box if you want to charge every late contract a late fee if the customer has multiple contracts

2: Late fees are PLUS tax instead of including tax.

Check this box if you want to have tax added to the late fees entered here instead of including tax. If you check this box and your late fee is $5.00 and your tax is 6% the late fee would be $5.00 +.30 tax for a total of $5.30. If you do not check this it would be $4.72 late fee and .28 tax for a total of $5.00

3: For Late Fee Per Payment or Per Payment by % charge only 1 late fee no matter how many pmts late.

Check this box if you only charge only 1 late fee no matter how many pmts late. This is ONLY for Late Fee Per Payment or Per Payment by % .

4: Check this box if you want to setup different per payment late fees by state

If you have customers in different states check this box if you want to setup different per payment late fees by state

5: For per day late fees the per day fee starts at end of grace period.

Check this box if you want the per day late fee to start after the grace period. With this checked and a 3 day grade period, $1.00 a day late fee, on the 4th day the late fee would be $1.00. Without it checked the late fee would be $4.00.

6: R - Rent to Own

Check this box if you want to charge late fees automatically on Rent to Own contracts

7: T - Rent to Rent

Check this box if you want to charge late fees automatically on Rent to Rent contracts

8: L - Lease to Own

Check this box if you want to charge late fees automatically on Lease to Own contracts

9: S - Open Retail Sales

Check this box if you want to charge late fees automatically on Open Retail Sale contracts

10: G - For Agent Contracts

Check this box if you want to charge late fees automatically on For Agent contracts

11: O - Other Contract Type

Check this box if you want to charge late fees automatically on Other type contracts

12: Method to calculate late fees for MONTHLY contracts

Use the drop down list to select the method to calculate MONTHLY late fees

13: Monthly Late Fee $

Fill in the late fee for monthly contracts

14: For Per Payment Late Fee by %, enter the % (for 5% enter 5)

If you charge late fees Per Payment by % enter the % here (Note for 5% enter 5)

15: For Per Payment Late Fee by %, enter MINIMUM Late fee $

If you charge late fees Per Payment by % enter the MINIMUM Late Fee here $

16: MAXIMUM Late fee $ (if applicable)

For Per Payment by % this is the Maximum per payment late fee. For other methods this is the Maximum late fees to charge no matter how late.

17: Use a table for Late Fee Rates

Checking this box will allow you to enter a rate table, for instance you could have a $2.00 fee if Pmt is > $5.00 and a $5.00 fee if Pmt is > $10.00

18: TABLE 1: If PMT Greater than

If you use a table for late fees this is the 1st or lowest PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

19: TABLE 1: FEE for PMT above

If you use a table for late fees this is the 1st or lowest late FEE you charge.

20: TABLE 2: If PMT Greater than

If you use a table for late fees this is the 2nd PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

21: TABLE 2: FEE for PMT above

If you use a table for late fees this is the 2nd late FEE you charge.

22: TABLE 3: If PMT Greater than

If you use a table for late fees this is the 3rd PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

23: TABLE 3: FEE for PMT above

If you use a table for late fees this is the 3rd late FEE you charge.

24: TABLE 4: If PMT Greater than

If you use a table for late fees this is the 4th PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

25: TABLE 4: FEE for PMT above

If you use a table for late fees this is the 4th late FEE you charge.

26: Charge Late fee when ? days overdue (Grace Period + 1)

For Monthly contracts this is how many days overdue when you charge a late fee. If your grace period is 2 days you should enter 3 here so late fees will begin on the 3rd day.

27: Only count days store is open for Grace Period

Check this box if you only want to count Open Days in the Grace Period. Example: If somebody is due Saturday and you are closed on Sunday, if your grace period is 1 day and they pay Monday there would be no late fee if you check this option.

28: Add a per Inventory Item per DAY Late Fee of:

If you put a figure here this will add a per inv item per day fee to the fees setup above. For example if you have set above to charge a $1.00 late fee per day and you put $1.00 here and a contract with 2 inventory items is 1 day overdue the late fee would be $3.00.

29: Method to calculate late fees for WEEKLY contracts

Use the drop down list to select the method to calculate WEEKLY late fees

30: Weekly Late Fee $

Fill in the late fee for monthly contracts

31: For Per Payment Late Fee by %, enter the % (for 5% enter 5)

If you charge late fees Per Payment by % enter the % here (Note for 5% enter 5)

32: For Per Payment Late Fee by %, enter MINIMUM Late fee $

If you charge late fees Per Payment by % enter the MINIMUM Late Fee here $

33: MAXIMUM Late fee $ (if applicable)

For Per Payment by % this is the Maximum per payment late fee. For other methods this is the Maximum late fees to charge no matter how late.

34: Use a table for Late Fee Rates

Checking this box will allow you to enter a rate table, for instance you could have a $2.00 fee if Pmt is > $5.00 and a $5.00 fee if Pmt is > $10.00

35: TABLE 1: If PMT Greater than

If you use a table for late fees this is the 1st or lowest PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

36: TABLE 1: FEE for PMT above

If you use a table for late fees this is the 1st or lowest late FEE you charge.

37: TABLE 2: If PMT Greater than

If you use a table for late fees this is the 2nd PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

38: TABLE 2: FEE for PMT above

If you use a table for late fees this is the 2nd late FEE you charge.

39: TABLE 3: If PMT Greater than

If you use a table for late fees this is the 3rd PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

40: TABLE 3: FEE for PMT above

If you use a table for late fees this is the 3rd late FEE you charge.

41: TABLE 4: If PMT Greater than

If you use a table for late fees this is the 4th PMT amount you charge a late fee for, you enter how much of a late fee to charge directly below this row.

42: TABLE 4: FEE for PMT above

If you use a table for late fees this is the 4th late FEE you charge.

43: Charge Late fee when ? days overdue (Grace Period + 1)

For Weekly contracts this is how many days overdue when you charge a late fee. If your grace period is 2 days you should enter 3 here so late fees will begin on the 3rd day.

44: Only count days store is open for Grace Period

Check this box if you only want to count Open Days in the Grace Period. Example: If somebody is due Saturday and you are closed on Sunday, if your grace period is 1 day and they pay Monday there would be no late fee if you check this option.

45: Add a per Inventory Item per DAY Late Fee of:

If you put a figure here this will add a per inv item per day fee to the fees setup above. For example if you have set above to charge a $1.00 late fee per day and you put $1.00 here and a contract with 2 inventory items is 1 day overdue the late fee would be $3.00.

46: Make Bi-Weekly and Semi-Monthly 2X weekly late fee.

Check this box if you only want the late fees for Bi-Weekly and Semi-Monthly contracts to be 2 times what the weekly amount would be.

47: Calculate Bi-Weekly and Semi-Monthly late fees the same as MONTHLY instead of Weekly.

Check this box if you only want the late fees for Bi-Weekly and Semi-Monthly contracts to be calculated the same as Monthly late fees instead of Weekly late fees.

48: Use seperate per payment structure below for O-Other type contracts

Check this box if you have a different Per Payment structure for O-Other type contracts.

49: Per Payment Late Fee by %, enter the %

For O-Other type contracts late fees Per Payment by % enter the % here (Note for 5% enter 5)

50: Per Payment Late Fee by %, enter MINIMUM Late fee $

If you charge late fees Per Payment by % enter the MINIMUM Late Fee here

51: Per Payment Late Fee by %, MAXIMUM Late fee $

For Per Payment by % this is the Maximum per payment late fee. For other methods this is the Maximum late fees to charge no matter how late.

DWF/LDW Tab

1: This store does NOT offer Damage Waiver

If you do not offer damage waiver in your store check this box, when loading agreements the DWF field will not be displayed with this checked.

2: Enter the initials you want to use for Damage Waiver

Damage Waiver Fee is the most common term or DWF. Some other common names: LDW is for Loss Damage Waiver, GRP is sometimes called Guaranteed Replacement Policy.

3: Make Damage Waiver a 1 time fee only paid on Down Payment(to use for tire disposal tax)

Check this box if you want to use Damage Waiver to track something such as a tire disposal tax, if you check this box the fee will be charged on the down payment but not on subsequent payments.

4: Allow loading agreements with Damage Waiver but not collect the fee with the down payment. A checkbox would have to be checked to not collect damage waiver in the down payment.

Check this box if you want to be able to load agreements with damage waiver, but not collect any damage waiver in the down payment. Normally when the down payment is loaded damage waiver is taken out of it, if this option is enabled and the checkbox is checked during the load no damage waiver would be taken out of down payment.

5: Automatically calculate and add Damage Waiver

If you want Damage Waiver to be calculated and added to contracts automatically check here.

6: Make Damage Waiver PLUS Tax instead of INCLUDING Tax. With this box checked and you set 1.00 minimum DWF fee it would be 1.00 + tax(1.07 for .07 tax) instead of including tax (.93 DWF .07 tax for .07 taxrate).

Make Damage Waiver PLUS Tax instead of INCLUDING Tax. With this box checked and you set 1.00 minimum DWF fee it would be 1.00 + tax(1.07 for .07 tax) instead of including tax (.93 DWF .07 tax for .07 taxrate). Note this only applies if you do not have DWF set to be NOT taxable under the sales tax tab.

7: Damage Waiver fee default % of payment

If you have Damage Waiver calculate automatically enter the rate here as a % of the payment (for 6% enter .06)

8: If you want the DWF fee to be a set amount per week/month per item enter 0 above and check this box.

Check this box if you want the DWF fee entered below to be per inventory item. Make sure you set the amount for 'Damage Waiver fee default % of payment' above to 0.

9: Damage Waiver Weekly MINIMUM Fee $

Enter the MINIMUM Weekly fee if applicable $

10: Damage Waiver Monthly MINIMUM Fee $

Enter the MINIMUM Monthly fee if applicable $

11: Damage Waiver Bi-Weekly MINIMUM Fee $

Enter the MINIMUM Bi-Weekly fee if applicable $

12: R - Rent to Own

Check this box if you want to charge damage waiver fees automatically on Rent to Own contracts

13: T - Rent to Rent

Check this box if you want to charge damage waiver fees automatically on Rent to Rent (Short term rental) contracts

14: L - Lease to Own

Check this box if you want to charge damage waiver fees automatically on Lease to Own contracts

15: A - Airtime Contracts

Check this box if you want to charge damage waiver fees automatically on Airtime Contracts

16: G - For Agent Contracts

Check this box if you want to charge damage waiver fees automatically on For Agent contracts

17: O - Other Contract Type

Check this box if you want to charge damage waiver fees automatically on Other type contracts

Other Tab

1: Next Customer ACCOUNT number to assign.

This is the account number that will be assigned to the next new customer.

2: When suggesting a Retail Price on new sales round to?

Example: If you enter .95, 115.23 would round to 115.95. If you enter 9.95, 115.23 would round to 119.95. Leave blank to NOT round. NOTE: This only rounds when the price is generated from the category markup, when the price comes from the "Retail" field that is saved with the inventory that price would be used and not rounded.

3: When loading a retail sale enter price from the suggested retail price automatically

Check this box if you want a retail price to be entered automatically when loading retail sales. You can change the price during the load process.

4: For Retail price default to category markup to get retail price instead of 'Retail' field

When you receive inventory a Retail price is saved with that record, if you want to default to the price calculated by category markup instead of the saved value click this box (normally they would be the same unless you recive an item then later change the category markup).

5: Show EPO$ (Early Payoff Amount) on the payment screen.

Check this box if you want the EPO$ displayed on the payment screen. You can always push F8 from the payment screen to see EPO$ if its not displayed.

6: Show price quote screen after receiving inventory

Check this box if you want the price quote screen displayed after receiving. The price quote screen displays prices based on markups you entered.

7: Make 'RENTAL' the default type when receiving inventory instead of 'RETAIL'.

Check this box if you want 'RENTAL' to be the default type of inventory. RENTAL inventory is counted as idle in BOR reports, RETAIL is not. You can change this choice during receiving.

8: Require Invoice number to be entered when receiving inventory.

Check this box if you want to require the invoice number to be entered when receiving inventory.

9: On the Customer Listing Report use weekly X 4 to project revenue instead of 4.33.

Check this box if you weekly X 4 to be used as projected revenue on customer listing instead of 4.33.

10: Next Generated Serial Number (Only used if you click the button generate serial number during receive).

Enter the next serial number you want to use when you have RTO Pro generate serial numbers.

11: Prefix to use for Serial number (only used if you click the button generate serial number during receive).

Enter any prefix you want to use to go in front of serial numbers that are generated by RTO Pro. For instance if you want all serial numbers to start with the letter "C" Enter C here

12: Digits for Serial #'s when generating automatically.

Enter the # of digits to use when generating serial #'s automatically. If you enter 5 the smallest serial # would have 5 digits in it such as 10200.

13: Automatically generate Stock #'s during receiving.

Check this if you want RTO Pro to generate Stock #'s automatically during the receiving process.

14: Next Stock # to use.

Enter the next stock # to use when generating them automatically.

15: When receiving always use last Retail amount instead of calculating based on cost.

Check this if you want to use the last Retail price for the model you are receiving instead of calculating retail price based on cost.

16: When receiving always fill in individual rental pricing table from the last item received with that model.

If you use the individual pricing table for rental pricing and want new items to match pricing from last matching item received check this box.

17: When loading rentals or retail sales only show exact inventory matches when entering stock or serial #'s.

If you check this and enter a stock or serial # when loading a new agreement the inventory list screen will be displayed with exact matches only instead of a complete ordered list.

18: Auto post notes to customers "More Comments" when mailing letters, invoices, printing runsheets etc.

If you check this box notes will be posted to customers more comments when letters, invoices etc are printed. Note these notes are automatically saved to the customers action table, saving to more comments also is doubling your notes.

19: When saving changes to More Comments automatically add date time and user note.

If you check this box anytime changes are made to more comments the users initials, date and time will be recorded also. For this to work you have to use Logon type security where the user logs on and stays logged on.

20: Use Google Map instead of MapQuest when using Map It

Check this box if you want the Map It feature to be linked to maps.google.com instead of Mapquest (Yahoo maps shut down 9/2011)

21: DO NOT display image from Document Imaging on Payment, Rental, C/A screens

Check this box if you DO NOT want to display the customers default image on the payment, new rental, new sale, new C/A loan screens

22: On tendered screen for Payments make the amount tendered 0.00 by default.

Making the amount tendered 0.00 by default will force employees to type in the actual amount tendered by the customer.

23: On tendered screen for Payments make the Payment Form blank by default.

Making the payment blank default will force employees to enter the actual payment form of the customer instead of just being able to push Enter for Cash.

24: On the contract info screen (F8 from the Payment screen) show the inventory Stock# instead of the model#.

25: When taking payments on closed agreements with back rent due credit the amount paid to RENT PAID instead of OTHER CHARGES.

If you check this box payments taken on closed agreements will show as rent paid instead of other charges paid.

26: Display inventory Stock # with description on contract Maint/Close screen.

If you check this the contract maint. and close screens will display stock# and description in the description space(some long descriptions may not display the entire description if you check this).

27: Allow Loading of Purchase Order Inventory.

Purchase Order Inventory is inventory that can be loaded and rented or pre-rented to a customer and placed on a need to order list, then when the ordered item comes in it will replace the PO item.

28: Require Transfer TO Store # when doing transfer out.

If you check this box the store being transferred to must be entered when doing tranfer out.

29: Method to Add Trip Charge automatically when printing RUN SHEET.

Use the drop down list to select the method to automatically add a trip charge when printing a Run Sheet

30: Trip Charge Fee amount.

Enter the amount you charge for a trip charge (when an account manager has to go to a customers house to collect payment).

31: When emailing form letters from the payment or on screen account manager do not open the letter and allow it to be edited, just email automatically.

Check this box if you want letters being emailed to be uneditable by end users.

32: Only allow inventory transfers to be done by Internet FTP.

Check this box if you want all delivery of transfer files to be done by internet FTP only.

33: FTP Server Address (For sending files to Home Office via FTP)

If you send data to your Home Office via FTP, enter the FTP Server Address here.

34: FTP User Name (For sending files to Home Office via FTP)

If you send data to your Home Office via FTP, enter the FTP User Name here.

35: FTP Password (For sending files to Home Office via FTP)

If you send data to your Home Office via FTP, enter the FTP SPassword here.

36: FTP Remote Directory (For sending files to Home Office via FTP)

If you send data to your Home Office via FTP, enter the FTP remote directory here (usually blank).

37: When this store transfers out if the item is new remove the date received.

This is generally for warehouses and NOT commonly used. If you want the received date to reflect the date received in a store and not the actual company received date check this box.

38: Enter the Server Name / IP address for the Server at the RTO Pro Home Office computer

For encrypted / secure access this should be something like "localhost/3051" (without the quotes). Note: For K-Secure VPN it should be the IP address of the router for your server computer at your home office such as "76.26.251.112".

39: Enter the path to the database file rtoproho.fdb on the Server computer

Normally "c:\rtoho\" (without the quotes).

40: Enter any SQL string you want to add to change what is seen in companywide inventory.

Call tech support for help with this option. If you do not want stores to see Home Office inventory you can enter: store <> 99

41: Enable the ability to take Payments for Remote Stores. (Must have RTO Pro Home Office with remote access info entered above, or use RTO Pro Web Services, see below)

If you check this box it will enable employees to take payments for other stores, the payment info will get sent to the other store via the RTO Pro Home Office or through the RTO Pro Web Services Server, see below.

42: Use RTO Pro Web Services for Companywide inventory inquiries and for Remote Payments to sync payments with stores.

If you check this box Remote Payments and companywide inventory inquiries will be synced through the RTO Pro web services server, so you can process remote payments and view companywide inventory without having to setup a VPN and without having RTO Pro Home Office/Corporate Edition. Contact RTO Pro to setup a web services login. This is free while on the RTO Pro support plan.

43: This computer is the one that will process payments taken at other stores(remote payment processing).

If this is the computer you want to process payments that are taken at other stores click this box, only 1 computer on the network can be assigned this task.

44: This store is setup for RTOWebPay Service (Allows your customers to pay payments online and view account info online).

To get more info on the RTO Pro Webpay service call 352-383-9375.

45: This store uses the RTO Pro Webpay system.

If you use the RTO Pro Webpay system for online payments check this box. For more info about the RTO Pro Webpay service call 352-383-9375.

46: This is the computer that will Sync with the WebPay server.

If this is the computer you want to Sync hourly with the WebPay server check this box. The Sync computer should be the server or the computer where most work in RTO Pro is done.

47: When processing payments charge late fee based on date PAID instead of date PROCESSED.

For instance if somebody pays online Saturday night after you close and you do not process it til Monday when you open, check this box if you want to base the late fee on Saturdays date instead of Mondays.

48: DO NOT Sync with the Webpay server when you run the End of Day, instead only sync on demand with the command line "c:\rtowin\income.exe -webpay".

Check this box if you want to control webpay syncs manually instead of when running the end of day. Syncs can be scheduled with Windows Scheduler with the command line "c:\rtowin\income.exe -webpay"

49: Webpay Web Services User Name (Only when a separate user/password is required)

Normally this is not required, you will be instructed by tech support if you need to enter anything here.

50: Webpay Web Services Password (Only when a separate user/password is required)

Normally this is not required, you will be instructed by tech support if you need to enter anything here.

51: Web Applications FTP Address

If you have web applications setup enter the FTP address RTO Pro will use to download the XML application files.

52: Web Applications FTP User Name

If you have web applications setup enter the FTP User Name RTO Pro will use to download the XML application files.

53: Web Applications FTP Password

If you have web applications setup enter the FTP Password RTO Pro will use to download the XML application files.

54: Web Applications FTP Sub Folder (optional)

If the web apps are stored in a subfolder of the folder the FTP account logs into, enter the folder name here. For normal FTP it is normally just the folder name for instance "WebApps". For Secure FTP (SSH) it is normally the entire path from the root folder of your web site, for instance for RTO Pro it is "/home/rtopro/public_html/webapps".

55: Use SSH File Transfer Protocol (also known as Secret File Transfer Protocol, Secure FTP, or SFTP) to transfer web applications. This is recommended since personal data such as social security numbers can be contained in the application data.

This is recommended since personal data such as social security numbers can be contained in the application data.

56: If this is the computer that will check for submitted web applications check this box (should be the most used computer).

57: Enter the Customer Status / Rating character to flag internet applications with(0-9)

What Customer Status you want to use to represent web applications. This should be a setting setup as a "Pending" status. All customers with this status will be displayed when you view the pending applications list.

58: When agreements are imported what steps should be taken

Use the drop down list to select what should be done when agreements are imported

59: Begin depreciation on inventory after received instead of waiting until after rented.

Normally depreciation begins after an item is rented, if you want to start depreciation as soon as it is received check this box.

60: Check this box if your fiscal year for depreciation is different than the calendar year. If your business's year is from 1-1 to 12-31 DO NOT check this.

If your fiscal year is not the same as a calendar year check this box and enter the last month of your fiscal year below.

61: Last month of your fiscal year 1-12.

If your business year is not the same as a calendar year check above and enter the last month of your fiscal year here. (June would be 6).

62: If you want to only allow 1 Inventory FP Agent to be used in this store during receiving enter it here.

If you want to make sure all inventory gets received under the same Agent name enter it here, otherwise leave this blank.

63: 1st Range #, usually 0 or 1.

If you want to setup custom days late ranges enter them here. The default settings are 0,3,6,15,30,60,90 which gives you ranges of 0-3, 4-6, 7-15, 16-30, 31-60, 61-90,91+

64: 2nd Range #, default is 3.

If you want to setup custom days late ranges enter them here. The default settings are 0,3,6,15,30,60,90 which gives you ranges of 0-3, 4-6, 7-15, 16-30, 31-60, 61-90,91+

65: 3rd Range #, default is 6.

If you want to setup custom days late ranges enter them here. The default settings are 0,3,6,15,30,60,90 which gives you ranges of 0-3, 4-6, 7-15, 16-30, 31-60, 61-90,91+

66: 4th Range #, default is 15.

If you want to setup custom days late ranges enter them here. The default settings are 0,3,6,15,30,60,90 which gives you ranges of 0-3, 4-6, 7-15, 16-30, 31-60, 61-90,91+

67: 5th Range #, default is 30.

If you want to setup custom days late ranges enter them here. The default settings are 0,3,6,15,30,60,90 which gives you ranges of 0-3, 4-6, 7-15, 16-30, 31-60, 61-90,91+

68: 6th Range #, default is 60.

If you want to setup custom days late ranges enter them here. The default settings are 0,3,6,15,30,60,90 which gives you ranges of 0-3, 4-6, 7-15, 16-30, 31-60, 61-90,91+

69: 7th Range #, default is 90.

If you want to setup custom days late ranges enter them here. The default settings are 0,3,6,15,30,60,90 which gives you ranges of 0-3, 4-6, 7-15, 16-30, 31-60, 61-90,91+

70: Enter the description for a Customer Rating/Status of 0

Enter description you want to use for a Customer Rating/Status of 0

71: Enter the description for a Customer Rating/Status of 1

Enter description you want to use for a Customer Rating/Status of 1

72: Enter the description for a Customer Rating/Status of 2

Enter description you want to use for a Customer Rating/Status of 2

73: Enter the description for a Customer Rating/Status of 3

Enter description you want to use for a Customer Rating/Status of 3

74: Enter the description for a Customer Rating/Status of 4

Enter description you want to use for a Customer Rating/Status of 4

75: Enter the description for a Customer Rating/Status of 5

Enter description you want to use for a Customer Rating/Status of 5

76: Enter the description for a Customer Rating/Status of 6 (Optional)

Enter description you want to use for a Customer Rating/Status of 6 (Leave blank if you do not want to use this status)

77: Enter the description for a Customer Rating/Status of 7 (Optional)

Enter description you want to use for a Customer Rating/Status of 7 (Leave blank if you do not want to use this status)

78: Enter the description for a Customer Rating/Status of 8 (Optional)

Enter description you want to use for a Customer Rating/Status of 8 (Leave blank if you do not want to use this status)

79: Enter the description for a Customer Rating/Status of 9 (Optional)

Enter description you want to use for a Customer Rating/Status of 9 (Leave blank if you do not want to use this status)

80: Enter the description for a Customer Rating/Status of A (Optional)

Enter description you want to use for a Customer Rating/Status of A (Leave blank if you do not want to use this status)

81: Enter the description for a Customer Rating/Status of B (Optional)

Enter description you want to use for a Customer Rating/Status of B (Leave blank if you do not want to use this status)

82: Enter the description for a Customer Rating/Status of C (Optional)

Enter description you want to use for a Customer Rating/Status of C (Leave blank if you do not want to use this status)

83: Enter the description for a Customer Rating/Status of D (Optional)

Enter description you want to use for a Customer Rating/Status of D (Leave blank if you do not want to use this status)

84: Enter the description for a Customer Rating/Status of E (Optional)

Enter description you want to use for a Customer Rating/Status of E (Leave blank if you do not want to use this status)

85: Enter the description for a Customer Rating/Status of F (Optional)

Enter description you want to use for a Customer Rating/Status of F (Leave blank if you do not want to use this status)

86: Enter the description for a Customer Rating/Status of G (Optional)

Enter description you want to use for a Customer Rating/Status of G (Leave blank if you do not want to use this status)

87: Enter the description for a Customer Rating/Status of H (Optional)

Enter description you want to use for a Customer Rating/Status of H (Leave blank if you do not want to use this status)

88: Enter the description for a Customer Rating/Status of I (Optional)

Enter description you want to use for a Customer Rating/Status of I (Leave blank if you do not want to use this status)

89: Enter the description for a Customer Rating/Status of J (Optional)

Enter description you want to use for a Customer Rating/Status of J (Leave blank if you do not want to use this status)

90: When running billing / invoicing allow excluding customers by rating / status.

If you check this box the customer rating / status list will be displayed on the billing screen so you can exclude customers with specific ratings/status.

91: When running the On Screen Account Manager(OSAM) allow excluding customers by rating / status.

If you check this box the customer rating / status list will be displayed on the OSAM screen so you can exclude customers with specific ratings/status.

92: Enter the custom message to print on invoices when the customer is not overdue

The custom message field can be added to your invoice form.

93: Enter the custom message to print on invoices when the customer 1-29 days overdue

The custom message field can be added to your invoice form.

94: Enter the custom message to print on invoices when the customer 30+ days overdue

The custom message field can be added to your invoice form.

95: Check this box for Time Clock privacy. With this box checked employees will only be able to see their own time clock records.

If this box is checked the employee password will be prompted for before the screen that displays time records, also the employee list will not show time in and out, only in or out status.

96: Keycode to enable Multiple Connections from this computer.

Call Tech Support for more info about this feature. This is only for multi-store companies.

Contracts Tab

1: Automatically generate Rental contract numbers

Check this box if you want the contract numbers to be generated automatically when you load rentals.

2: Do not allow the generated Rental Contract number to be changed

Check this box if you don't want to allow the generated rental contract numbers to be changed.

3: Automatically generate Open Retail Sale contract numbers

Check this box if you want the contract numbers to be generated automatically when you load Open Retail Sales.

4: Enter any prefix that you want before the contract#.

Example: If you want all of your contract #'s to start with a 'C' enter 'C', then contract # 100 would be C100. This is only used if contract #'s are generated automatically

5: Enter the next contract # you want to use.

This is the next contract # that will be used when automatically generating contract numbers.

6: When Monthly agreements pay partial calculate daily rate as monthly / 28 (monthly /4 /7). Also use Monthly / 4 = weekly for term changes.

Check this box if you give a discount to monthly agreements (weekly x 4 = monthly) and want to charge the full weekly rate for partial payments. Example with this box checked a 28.00 a month agreement 14.00 would pay for 14 days, without this box checked 14.00 would pay for 15 days.

7: Default number of Payments Down to Collect on rentals.

This is the number of down payments to collect by default on rental agreements. This can be changed as you load each agreement.

8: When loading rental agreements collect down payment based on next due date.

Check this if you want to force the down payment to equal the amount needed to pay to the next due date. For instance if its a weekly agreement and you set the next due date 9 days from now collect 1 week + 2 days rent as down payment. With this checked you cannot load an agreement and give Free Time (unless you click the link that can be password protected to allow free time, see security to password protect the link).

9: Suggest an Inventory Payment Rate when loading/printing contracts.

Check this box if you want the payment amount that you setup when receiving inventory to be suggested as the payment amount when loading contracts. With this boxed checked rental rates will come up automatically, the rate can be changed on the fly, and lowering the rate below the setup rate can be password protected.

10: Make Weekly rate Monthly Rate divided by 4.33 instead of 4 (Bi-Weekly would be Monthly divided by 2.165 instead of 2).

Check this box if you want the weekly rate to be monthly / 4.33 and bi-weekly to be monthly / 2.165 (Normally weekly = monthly /4 and bi-weekly = monthly /2). Note this setting is for pricing only not for how to handle partial payments on monthly agreements.

11: Use Simplified markup method (cost x markup / # of pmts) instead of (cost x markup / #months / 4.33 or 4).

If you check this box and your markup is 1.2x cost and something cost 799.99, 11 months would =87.27 and 48 weeks would = 20.00. Without this box checked if you use /4.33 to get weekly pmt, 11 months would =87.27 and 48 weeks would = 20.15. NOTE: IF YOU CHECK THIS BOX WEEKLY PAYMENT RATES WILL NOT ROUND EVEN IF YOU HAVE THE BOX BELOW CHECKED.

12: Round up Weekly AND Monthly payments if you have it set to round up in category markup.

Check this to round all payments. If this is not checked pricing is done as follows Monthly price is rounded up then divided by (4.33 or 4) to get weekly. If this IS CHECKED it will calculate as follows Monthly price is divided by (4.33 or 4) then rounded up for weekly.

13: For payment amount use RTO$ field as contract amt divided by # of Payments.

Check this box if you want the payment amount to be calculated as the RTO$ field divided by # of payments (If this is not checked pricing is done by inventory category markup. NOTE: This box is not commomly checked, most stores use category markup method for pricing, see the help topic "Pricing Setup" for more info (push the F1 key and click the "See Also" button to go to the Pricing Setup topic).)

14: When 2 names are on contract print what term in between names?

If you print a contract with primary and alternate customers name both on it, what term should be printed in between the names? Normally if both customers are signing it should be AND so both customers are responsible.

15: For Cash Price on printed contracts use Inventory Markup instead of % of contract amount.

Check this box if you want to calculate cash price that is printed on contracts by the Inventory Markup method instead of Percentage of Contract method. If checked the cash price on contract would be the cash price entered with inventory, if cash price is empty the default markup in the setting below would be used.

16: Inventory Markup default % of profit on sale.

If you are using the Inventory Markup metod to calculate cash price on contracts enter the % of profit on sale, for 40% gross profit enter .4

17: Cash Price by % of contract amount enter the %(for 50% enter .5).

If you are using the % of contract method to calculate cash price enter the % here. If you enter .5 and the contract amount is $1000.00 the cash price would be $500.00

18: Prompt to print Contracts if not pre-printed when loading contracts.

Check this box if you want to be prompted to print Contracts when loading agreements.

19: Prompt to print Payment Coupons when loading contracts.

Check this box if you want to be prompted to print payment coupons when loading agreements.

20: Term to print on contracts when inventory is NOT NEW.

When an inventory item is NOT NEW this is the term that will be printed on the contract(If your contract form has the inventory condition field on it). This is normally Pre-Leased or Used.

21: Force entry of Salesman when loading new agreements.

If you check this box you will not be able to load new agreements without entering Salesman

22: Do not attach Salesmen to employees. This will allow you to add salesman on the fly but your salesmen list will not be attached to your employee list if you check this. IT IS RECOMMENDED THAT YOU DO NOT CHECK THIS BOX.

If you check this the salesmen list will be a separate list from your employee list, which would allow you to add salesmen without adding an employee.

23: Auto select agreement to print for Rent to Own contracts by state. (For multi-state stores)

If you check this box the agreement file would be chosen by the state the customer is in. For instance if the customers state is "FL" the agreement printed would be the file "C:\rtowin\docs\FL agreement.rtf"

24: Automatically enter a Processing/Delivery fee for all agreements. Enter the amount here.

If you want to automatically enter a set Processing/Delivery fee for all agreements enter the amount here. The amount can be changed/removed when you load each agreement. Leave it blank or 0 if you do not want to have the system enter a fee automatically. If you do want the system to enter a default fee enter the amount here.

25: Add tax to Processing / Delivery fee instead of the amount including tax.

If you check this box the and enter 10.00 processing fee and your tax rate is .07, the total charged would be 10.70(10 + .7 tax). If you do not check this box and you enter a proc. fee of 10.00 it would be 9.35 fee and .65 tax.

26: Allow entry of a separate Processing and Delivery fee instead of one amount for both.

If this box is checked you can enter a separate delivery and processing fee when loading agreements. This is only so your agreement can separate the two fees, reports will group the two together. Make sure you add the field to your agreement {del_sep} to print the delivery amount if you check this box.

27: Default NSF Fee (no $, numbers and decimal only, for instance 25.00).

If you want the NSF fee entered automatically when you load an NSF check enter the amount here. Do NOT use $, enter numbers and decimals only (for instance 25.00).

28: When a Inventory Switchout is done on a contract automatically print a new agreement.

If you want an agreement to print automatically when a Inventory Switchout is done check this box.

29: Do not allow billing or invoicing in this store.

Check this box if you do NOT mail out invoices or bills to your customers.

30: By default set contract billed to YES (can be changed to NO manually).

Check this box if you want the default choice for new contracts to be billed to YES.

31: Remind me to run billing from the Main Menu

Check this box if you want to be reminded to run billing on the Main Menu. You will only be reminded according to your billing settings, if you run billing on every Monday you would be reminded on Mondays.

32: For payment amount use Retail / 21.6 = Pmt x 36 months.

Check this box if you want the payment amount to be calculated as Retail divided by 21.6 x 36 months (portable building rentals normally).

33: Use the Shed pricing utility when loading agreements (this helps with the way shed rentals normally do pricing).

Check this box if you want the Shed Pricing Utility to open when you are loading agreements, this helps shed rental companies load agreements the way they do their markups and pricing.

34: Allow Purchase Reserve to be Paid down to reduce the payment amount.

Check this box to allow a Purchase Reserve to be paid down with new rentals to reduce the payment amount.

35: Separate Extra money paid down from the normal terms. THIS FEATURE AND PURCHASE RESERVE CANNOT BE BOTH ENABLED.

Check this box to separate extra money paid down from normal terms. With this box checked if a customer pays 500 extra down and has 36 pmts x 100, their contract info screen would show 36 total payments instead of 41 (4100 / 100). Also if you use the EPO method Cash - % of rent paid = EPO, the original cash price can be saved in contract detail instead of the reduced cash price(reduced by down payment).

36: Require customer address, home phone, message phone and DOB before a rental/ open sale can be loaded.

If you check this box rental agreements and open retail sales(retail sale with payments) cannot be loaded unless the customer address, home phone, message phone and DOB is entered in RTO Pro.

37: If the box above is checked require Cell Phone# entry instead of Message#.

If you check this box and the box above are checked rental agreements and open retail sales(retail sale with payments) cannot be loaded unless the customer address, home phone, CELL PHONE, and DOB is entered in RTO Pro.

38: Require Customers Social Security Number to be entered.

If you check this box rental agreements and open retail sales(retail sale with payments) cannot be loaded unless the customer's Social Security is entered.

39: Require customer Email address before a rental/ open sale can be loaded.

If you check this box rental agreements and open retail sales(retail sale with payments) cannot be loaded unless the customer's Email address is entered in RTO Pro.

40: Number of customer references to require 0 to 6.

Fill in the number of customer references you require, their name and phone would be required unless the box below is checked also then their address would be required as well.

41: Require references address.

If you check this box rental agreements and open retail sales(retail sale with payments) cannot be loaded unless the references address is entered in RTO Pro. The number of required references is determined by the setting above.

42: Do not allow loading of a rental/ open sale if the customer has a 0 rating.

If you check this box rental agreements and open retail sales(retail sale with payments) cannot be loaded if the customer has a '0' rating.

43: Calculate payoff amounts by using the "Rule of 78's" (See the note for this option and check your state laws before using this option)

Check this box if you want to calculate payoffs for Installment Sales using the Rule of 78's. Note: Check your state laws and use at your own risk, using Rule of 78's for calculating payoffs is illegal in many states and is illegal to use in ALL states for consumer loans longer than 61 months.

44: If using the "Rule of 78's" don't give credit for partial months for payoff calculation.

If you check this box and a installment loan is started on the 1st of a month, anytime after the 1st of any following month the full month interest would be considered earned for payoff calculation.

45: For Installment Sales if you want a set APR(same APR for all Installment Sales) enter the APR here (for 18% enter 18).

Note if you enter an APR here you will not be able to change the APR when loading an installment sale.

46: Round Installment Payments to whole dollars .49 rounds down, .50 rounds up.

If you want the calculated Installment payment to be rounded to full dollars check this box, the APR would be adjusted for the rounded payment and rounded to the 100th (18.01589152759 APR would round to 18.02).

47: Handle L-Lease contracts like Federal Lease Law (5 month minimum with balloon payment).

Check this box if you want all L-Lease contracts to be handled like a federal lease instead of like a normal RTO agreement. See the help file (F1) Federal Lease topic for more info.

Ballooon: months < 13 balloon = 2 months, months 13 to 18 balloon = 3 months, months > 18 balloon = 4 months

48: Make Federal Lease Balloon always 2 payments.

Check this box if you want all L-Lease contracts to be handled like a federal lease and you want the balloon payment to always equal the amount of 2 normal payments.

49: Handle L-Lease contracts as follows: NO EPO Discount, 4 month +11.1111% minimum (2 month +11.1111% min on 3 month agreement) No balloon.

Handle L-Lease contracts as follows: NO EPO Discount, 4 month +11.1111% minimum (2 month +11.1111% min on 3 month agreement) No balloon. Amount due if returned before minimum term is calculated as follows: minimum term$ - (amount paid + 11.1111%) + tax (plus any other charges due)= amount due

50: Enable Extension Payments as follows: Have Extension link on payment screen that accepts 55.55% of a normal payment in other charges to move due date to the specified due date.

Have Extension link on payment screen that accepts 55.55% of the normal amount due in other charges to move due date on the payment screen. Note the 55.55% will replace ALL other charges that are due and after the due date is moved there will be no other charges due (unless they are still late after the due date is moved). Note this function can be password protected also.

Bonus Bucks Tab

1: Use 'Bonus Bucks' in this store.

Check this box if you want to use Bonus Bucks. Bonus Bucks is a way of rewarding customers that pay on time. Bonus Bucks will accumulate as payments are paid within the time period you set above. The customer can then use the Bonus Bucks to pay payments or down payments on new rentals as you specify.

2: Use 'Bonus Bucks' to pay Payments.

Check this box if you want to allow customers to use accumulated Bonus Bucks to pay Payments.

3: Use 'Bonus Bucks' to pay for New Rentals.

Check this box if you want to allow customers to use Bonus Bucks to pay for New Rentals.

4: Only Credit Bonus Bucks on contracts with CLUB and for customers with a Club Only agreement.

Check this box if you only want to credit Bonus Bucks to customers with Club. With this checked the customer would have to have club on their normal agreement or have a club only agreement to get credited bonus bucks.

5: Credit Bonus Bucks when paying how many days in advance?

If you want to credit Bonus Bucks when the customer pays on time enter 0, if you want to only credit Bonus Bucks when they pay 1 day early enter 1. YOU CAN PUT A NEGATIVE NUMBER HERE IF YOU WANT TO APPLY BONUS BUCKS TO LATE PAYMENTS ALSO. To give bonus bucks when up to 30 days late enter "-30."

6: Bonus Bucks New Rental Bonus$

If you want to give a set amount of Bonus Bucks for a new rental instead of using the % of payment enter the amount here.

7: Credit Bonus Bucks per payment at a set amount instead of as a % of payment.

Check this box if you want to credit Bonus Bucks on a flat rate basis instead a percentage of the payment.

8: Credit Bonus Bucks at what percentage of payment?

If you want to credit Bonus Bucks as a % of the payment enter the percentage here(for 2% enter .02)

9: Weekly Bonus Bucks Amount$

If you want to credit Bonus Bucks as a set amount enter the WEEKLY Bonus here. For Monthly contracts this will be X 4, for Bi-Weekly and Semi-Monthly X 2.

10: Credit Bonus Bucks if Weekly Payment is GREATER than$

If you want to credit Bonus Bucks as a set amount ONLY if the payment is above a set amount enter that WEEKLY amount here. For Monthly contracts this will be X 4, for Bi-Weekly and Semi-Monthly X 2.

11: R - Rent to Own

Check this box if you want to credit Bonus Bucks on Rent to Own contracts

12: T - Rent to Rent

Check this box if you want to credit Bonus Bucks on Rent to Rent (Short term rental) contracts

13: L - Lease to Own

Check this box if you want to credit Bonus Bucks on Lease to Own contracts

14: A - Airtime Contracts

Check this box if you want to credit Bonus Bucks on Airtime contracts

15: G - For Agent Contracts

Check this box if you want to credit Bonus Bucks on For Agent contracts

16: O - Other Contract Type

Check this box if you want to credit Bonus Bucks on Other type contracts

Same as Cash Tab

1: Print Same as Cash balance with expiration date on receipts.

Check this box if you want to Print Same as Cash balance with expiration date on receipts.

2: Default MONTHS for Same as Cash (0 if you want to use days)

Enter the number of months Same as Cash you offer, this is only the default choice, it can be changed when loading an agreement.

3: Default DAYS for Same as Cash (0 if you want to use months)

If you want to do Cash you offer by DAYS instead of months enter the # of days here (0 if you want to use months).

4: Always use same as cash payoff when in SAC period, even if it is more than regular early payoff amount.

Check this box if you want to use same as cash payoff when in SAC period, even if it is more than regular early payoff amount.

5: R - Rent to Own

Check this box if you want to offer same as cash on Rent to Own contracts

6: L - Lease to Own

Check this box if you want to offer same as cash on Lease to Own contracts

7: G - For Agent Contracts

Check this box if you want to offer same as cash on For Agent contracts

8: O - Other Contract Type

Check this box if you want to offer same as cash on Other type contracts

Club / Central File / Datatrue / Text MSG Tab

1: This store does NOT offer a Club Program

If you do not offer a Club program in your store check this box. With this box checked the Club field will not be displayed when loading agreements.

3: Percentage of payment to automatically charge as Club Fees(for 5% enter .05)

If you want to automatically add club to every rent to own agreement enter the percentage of the payment to charge as Club Fees.

4: Default Club Fee for MONTHLY CLUB ONLY agreements:

A Club Only agreement is an agreement with club only, no inventory on it. If you want to have a default club fee for MONTHLY terms enter it here (it can be changed at time of loading).

5: Default Club Fee for WEEKLY CLUB ONLY agreements:

A Club Only agreement is an agreement with club only, no inventory on it. If you want to have a default club fee for WEEKLY terms enter it here (it can be changed at time of loading).

6: Default Club Fee for BI-WEEKLY CLUB ONLY agreements:

A Club Only agreement is an agreement with club only, no inventory on it. If you want to have a default club fee for BI-WEEKLY terms enter it here (it can be changed at time of loading).

7: Default Club Fee for SEMI-MONTHLY CLUB ONLY agreements:

A Club Only agreement is an agreement with club only, no inventory on it. If you want to have a default club fee for SEMI-MONTHLY terms enter it here (it can be changed at time of loading).

8: This store uses the PTS Direct Benefits Club Program. For more info contact PTS Direct Benefits: Phone: 706-602-0597 Email: directbenefits@ptsfinancialservices.com Web: www.ptsfinancialservices.com

For more info contact PTS Direct Benefits: Phone: 706-602-0597 Email: directbenefits@ptsfinancialservices.com Web: www.ptsfinancialservices.com

9: Treat Club like an Extended Warranty program and include full club contract amount(club fee x payments - clubpaid) in payoff.

If this box is checked club fee will be treated like an Extended Warranty plan. The EPO calculation will be normal EPO + (club fee x payments) - clubpaid.

10: Central File Group #

RTO Pro can generate Central File Mail List’s. These lists are used by Central File for direct mail advertising and other services. To get information about Central File’s services you can reach them at 800-749-6245. The group # they assign to you goes in this box.

11: DataTrue Account number

If you have a DataTrue account enter the account number here. To get information about DataTrue's services you can reach them at 209-951-9375.

12: DataTrue Password

If you have a DataTrue account enter the password here. To get information about DataTrue's services you can reach them at 209-951-9375.

13: DataTrue Office

If you have a DataTrue account enter the Office specifier here. To get information about DataTrue's services you can reach them at 209-951-9375.

14: DataTrue Report Version

If you have a DataTrue account enter the Report Version here. To get information about DataTrue's services you can reach them at 209-951-9375.

15: DataTrue Port Number

If you have a DataTrue account enter the Port Number here. To get information about DataTrue's services you can reach them at 209-951-9375.

16: DataTrue Xml Post program, this program MAY be required on every computer you wish to pull DataTrue reports from. Please note this is not required for the new Datatrue report process. Inquire with Datatrue if this is required for your company.

DataTrue Xml Post program, this program MAY be required on every computer you wish to pull DataTrue reports from. To get information about DataTrue's services you can reach them at 209-951-9375.

17: SMS Text Account Number

If you have a SMS Text account with RTO Pro enter the account number here. To setup an account call 352-383-9375. With a SMS Text account you can send texts to customers and receieve texts also.

18: SMS Text PHONE Number

If you have a SMS Text account with RTO Pro enter the Text PHONE NUMBER here. To setup an account call 352-383-9375. With a SMS Text account you can send texts to customers and receieve texts also.

19: Allow Texting to ANY Cell number unless it has OPTED OUT

Check this box if you want to allow text messages to be sent to any of your customers cell numbers unless they have specifically opted out.

20: Only Allow Texting to Cell numbers that have OPTED IN

Check this box if you only want to allow text messages to be sent to your customers cell numbers that have specifically OPTED IN. Note that any customer who texts you with STOP will be opted out in the system anyway and texts to that number will not be sent.

21: To enable a "Transaction Fee" to be added to payments enter the fee here. For a set amount enter the amount here, example "5". To make it a % of the total transaction enter a percent here, example "2%".

The transaction fee would be tracked in the Club field in revenue reports, the amount you enter should be the transaction fee INCLUDING TAX... if its taxable. For a set amount enter the amount here, example "5". To make it a % of the total transaction enter a percent here, example "2%". To charge the transaction fee you click a button on the Payment Tendered screen.

22: Transaction Fees AND Club fees are NOT TAXABLE

Check this box if Club are AND Transaction Fees NOT TAXABLE. NOTE: Club is generally taxable in EVERY state.

23: Record Transaction Fees as "Other" charges instead of "Club".

Checking this will make transaction fees be added to Other charges on reports instead of club fees. Also with this checked whether transaction fees are taxable or not will depend on your setting under the sales tax tab if other charges are taxable or not.

24: Automatically add a Transaction fee to all Autopay Payments.

Checking this will make transaction fees be added to all payments paid by Autopay, the amount that will be charged will be based on your setting above.

25: Automatically add a Transaction fee to all CREDIT CARD Payments.

Checking this will make transaction fees be added to all payments paid by CREDIT CARD, the amount that will be charged will be based on your setting above. Please note there will be a button to remove this fee which can be password protected in security.

Receipts Tab

1: Print receipts when moving due dates

Check this box if you want to print a receipt when you move due dates

2: Print description of 1st inventory item on small receipts(receipts printed with a receipt printer such as a Star TSP100)

Check this box if you want to print the description of the 1st inventory item on receipts printed with a receipt printer. This helps the customer know which contract is for what when they have multiple contracts.

3: Print Early Payoff amount with Discount (EPO) on Small Receipts.

Check this box if you want to Print Early Payoff amount with Discount (EPO) on Small Receipts (receipts printed with a receipt printer, such as a Star TSP100)

4: When printing the Early Payoff Amount (EPO) print the term:

This is what will be printed on receipts as a label to the EPO, Early Payoff amount, typically 'Payoff Amount$' is used.

5: Don't print regular payoff (EPO) when in Same as Cash period.

If you check this box the EPO will not be printed on receipts when the contract is still in the Same as Cash period.

6: Automatically Email copy of all receipts if customer has Email on file.

If you check this box an email will be sent for ALL Receipts generated if the customer has a saved email on file.

7: Save copies of all receipts in "AllReceipts" subfolder on the server computer.

If you check this box a copy of all receipts will be saved under the rtowin\allreceipts subfolder on your server computer. Note the last 1000 receipts are always saved locally and ALL receipts are saved in a receipts database, so this is really overkill and not recommended.

8: On Receipts show # of Payments Remaining

Check this box if you want to Print # of Payments Remaining

9: On Receipts show Balance

Check this box if you want to Print Balance on receipts

10: On Receipts show # of Pmts and Balance

Check this box if you want to Print # of Pmts and Balance

11: Do not Show Balance or Pmts Left On Receipts

Check this box if you do not want to print Balance or Pmts Left On Receipts

12: New York Law, show Balance/EPO and difference On Receipts

Check this box if your store is in New York and the balance, EPO and difference between the 2 will be printed

Cash Advance Tab

1: For APR calculation use 360 days instead of 365 for a year.

Check this box if you want to calculate Cash Advance APR using 360 days as a year instead of 365. This is required in some states, check your local laws.

2: Calculate C/A Fees at what %? (for 15% enter .15)

If you want Cash Advance fees to be calculated automatically as a % of the loan enter the % here as a decimal number.

3: Minimum Loan Days?

If you have a minimum # of days a C/A Loan can be for, enter it here.

4: Maximum Loan Days?

If you have a maximum # of days a C/A Loan can be for, enter it here.

5: Maximum Loan Amount$ ?

If you have a maximum loan amount for C/A Loans enter it here.

6: Allow charging of a Verification / Other fee (Non renewable loans only).

Check this box if you allow charging of a Verification / Other fee (Non renewable loans only).

7: If loan is paid off in 1 business day don't charge Interest.

Check this box if you do NOT charge interest if the loan is paid off in 1 business day.

8: Calculate APR as follows [(Fee / LoanAmt) / LoanDays] X 365 X 100 = APR. This is required in Arkansas. (Check your state guidelines)

Check this box if you Calculate APR as follows [(Fee / LoanAmt) / LoanDays] X 365 X 100 = APR.

9: Calculate fee as follows: Loan Amount X (Loan days/Days in month X .2) with a min. of $30.00 (Wyoming law)

Calculate fee as follows: Loan Amount X (Loan days/Days in month X .2) with a min. of $30.00 (Wyoming law).

10: Do not allow a new Cash Advance loan if customer has a open loan or if they still owe for any closed loan.

Check this if you only allow customers to have 1 loan at a time.

11: If a customer has 4 or more consecutive CA Loans within 5 days offer a Payment Plan. (Required in Colorado)

Check this if you are required to offer a Payment Plan Option.

12: If a customer has 8 or more CA Loans in 1 years time offer a Payment Plan. (Required in Michigan)

Check this if you are required to offer a Payment Plan Option.

13: Require entry of a state transaction / approval # on new loans.

Check this box if you want to force entry of a state trans/approval # before loading a new loan.

14: Colorado Cash Advance Rules.

Colorado rules are as follows: Allow principal paydown on renewal and auto calculate Cash Advance Loan fee as follows 20% up to $300 and then 7.5% up to $500.

15: Enable Missouri Cash Advance Principal Paydown Rule.

Missouri requires a 5% (of original loan amt) principal payment with each renewal payment.

16: Do not allow loading of Cash Advance Loans unless the customer's ACH info is saved.

Check this box if you want to require ACH info (account number, routing number) to be collected before loading a Cash Advance loan.

17: Allow Cash Advance Renewals without a new contract.

Check this box if you allow customers to pay a renewal fee to renew a Cash Advance Loan.

18: Default renewals to allow?

If you allow renewals enter how many you allow before the loan has to be paid.

19: Automatically print new Cash Advance Agreement on renewal payment.

Check this box if you want to Automatically print a new Cash Advance Agreement when a renewal payment is paid.

20: Prompt for new check # on renewal payments.

If you get a new check when a customer pays a renewal check here and you will be prompted for the new check #.

21: When renewing and overdue set next due date from date paid.

If you check this box and a C/A weekly renewal payment is due on Monday and it is paid on Tuesday, the next due date would be the next Tuesday.

22: Do NOT Print Receipt on renewal or New C/A Loan.

If you check this box receipts will not be printed on renewals or on new loans.

23: On C/A renewable type loans Do NOT charge extra interest when late.

Check this box if you do not charge extra interest on renewable C/A loans when they are overdue.