A common support question we get is why am I short or why am I over, this is something that we generally cannot help with since we have no way to tell what actually went in your drawer or what was actually collected for each transaction entered. In this help topic we will try to give you some basic steps you should go through to find a shortage or overage.

First we will explain what causes an overage or shortage.

Overage: An overage is caused by putting money or checks in your drawer or entering a credit card charge and either not entering the transaction in RTO Pro or entering it for less than the amount of money put in the drawer.

Shortage: A shortage is caused by entering a transaction in RTO Pro and not putting the money or checks in the drawer, or not charging a credit card.

A note about the credit card deposit amounts that are entered automatically in the end of day.

These are entered for your convenience from the records provided by your credit card processor and other records, such as webpay payments. This can be turned off in settings so the deposits are not entered automatically for you. These are not always accurate, for instance if you process a credit card webpay payment, then reverse it and re-enter it, the system will not know to add that amount to the credit card deposit. Always verify this deposit amount is correct.

Below is how it is calculated.

Credit card deposit = total LOCAL CC charges as provided by your credit card provider for the day + any webpay credit card payments processed.

Webpay CC payments processed could include payments paid previous days through the webpay system (paid online after you close and not processed until the next day).

To reconcile an overage or shortage the best thing to do is to look at a transaction report for the day (revenue menu option 2), look at each transaction and verify the correct amount of cash, check or credit card was put in the drawer for each transaction. For credit card transactions you should pull up your credit card transactions in your terminal or run a report in Xcharge if you use Xcharge and verify every credit card transaction on the payment/transaction report has a matching transaction in your credit card report.

Remember that for every transaction that involves money there must be a matching action in the drawer. If you take a $50 payment, you must put $50 cash, check or a CC charge for $50 in the drawer or you will be short $50.00. If you refund a payment of $100, you must take $100 out of the drawer or in the case of a transaction being reversed because of an NSF check or ACH return create a negative deposit(-100.00) to account for that refund or you will be over $100.00. In the case of a refund for an NSF check a receipt should be placed in the drawer so you remember at the end of the day to enter a negative deposit to match the transaction, this is the case with any transaction where there is no matching action in the drawer, you should place a note or receipt in the drawer to track it.

If you accept credit cards or ACH it is always a good idea to put a copy of the credit card or ACH receipt in the drawer so you can track it just like cash when you run the end of day, this way it is easy to go back and see if every CC transaction had an approved CC sale and every approved CC had a matching transaction.

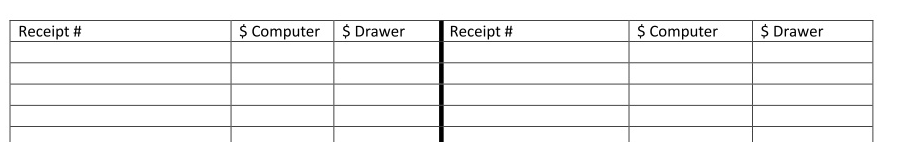

For companies that deal with mostly cash it can be hard to track down an overage or shortage, since there is no way to tell who's cash is in the drawer and who's is missing. If your store is having a lot of issues with overages or shortages it is helpful to have a sheet like the one below that you can have your employees fill out for every transaction, this will reinforce the idea that no transaction can be entered unless there is a matching one in the drawer. It will also enforce the fact that no transaction is complete until you have a transaction receipt and a matching transaction in the drawer, or in the case of a CC transaction it is not complete until the transaction receipt is done, the CC receipt is done and the receipt is put in the drawer.

If you want to use this form you can Click here to download the PDF.

Use this chart like you would balance your check book. Record the receipt number for every transaction and record what has been entered in the computer, as well as what has been put into or taken out of the drawer.

How overage / shortage is calculated from the entries on the End of Day:

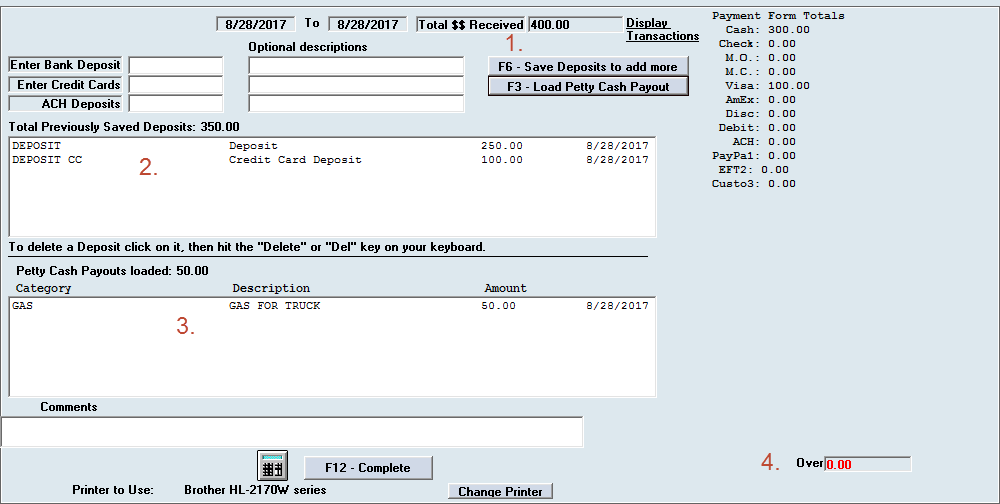

Below is a screen shot of the RTO Pro End of Day. Each section is described below and the calculations to determine overage / shortage.

1. This is the total dollar amount of all money the store received for this time period, including all payment forms.

2. This is the saved deposits, saved deposits are entered in the boxes above, bank deposits, credit card deposits or ACH deposits.

3. This is the petty cash payout for the store. Petty cash payouts are when you take money out of the drawer, or add money to the drawer that is not accounted for in RTO Pro, like taking cash out of the drawer to buy gas for a vehicle.

4. This is the overage or shortage.This is calculated as "total received" - ("deposits" + "petty cash"). If Total received is greater than deposits + petty cash you have a shortage, if total received < deposits + petty cash you have an overage. This is shown in a calculation below, for the example in the screen shot.

1. 400.00 You brought in $400, 300 in cash, 100 in Visa

2. 350.00 You deposited $350.00, 250 in cash, 100 Visa

3. 50.00 You took $50.00 cash out of the drawer to pay for gas

400 - (350 + 50) = 0, so you are over/short 0.00, or balanced.

In this same example, if nothing else was changed and you had $40 petty cash payout instead of $50, you would be short $10.00 (400 -(350+40)) =10.00 shortage... you are accounting for only $390 of the $400 you brought in.

In this same example, if nothing else was changed and you had $60 petty cash payout instead of $50, you would be overt $10.00 (400 -(350+60)) = -10.00, which means an overage... you only brought in $400, but deposited and paid out $410.00, so somehow you deposited too much, where did the extra $10.00 come from? This is an overage.