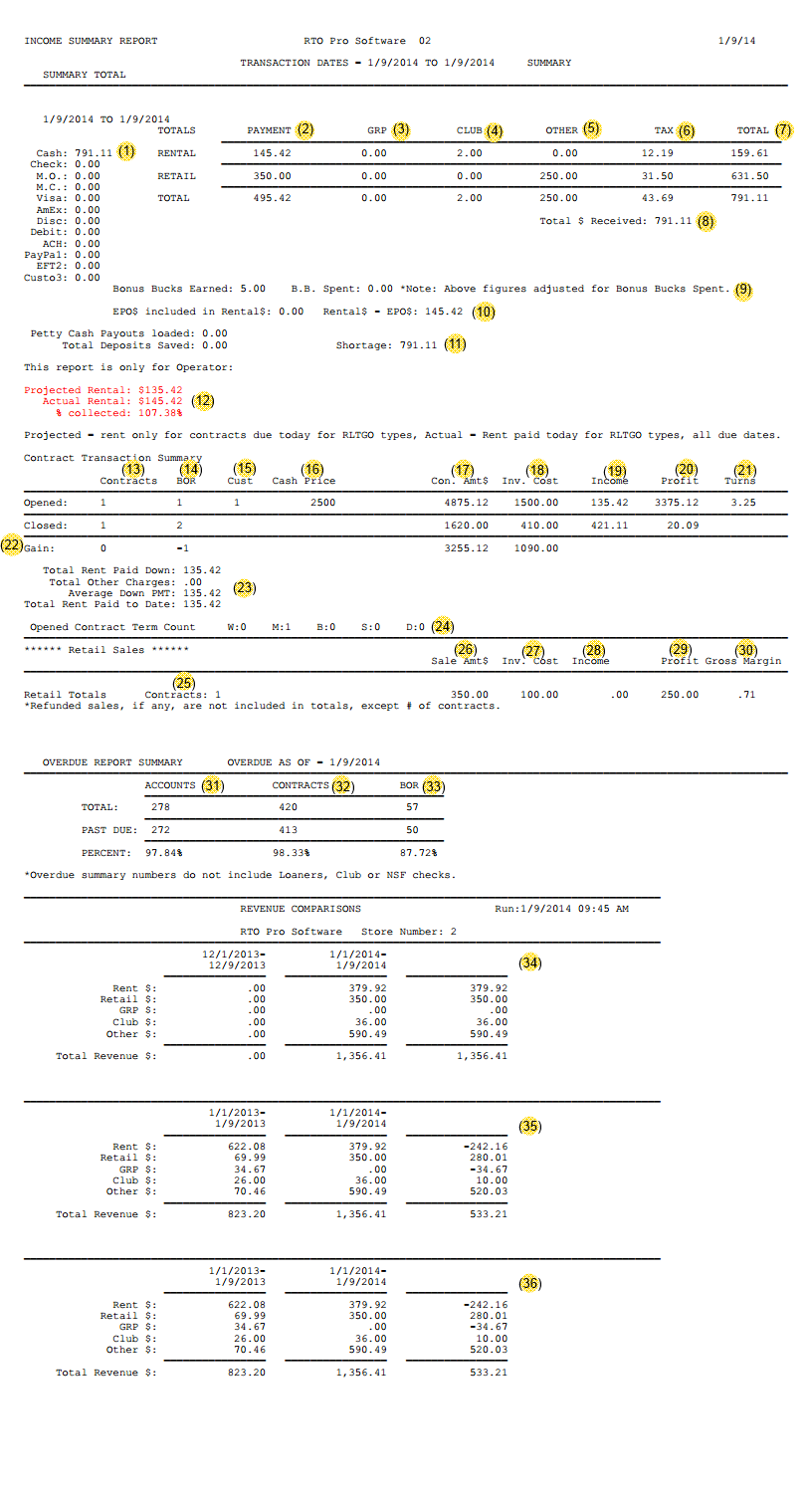

The Quick Revenue Summary Report will display an income summary, contract transaction summary, overdue report summary, and revenue comparisons for any given date range.

Below are the definitions for the highlighted sections on the sample report below.

(1). Form of payment for all monies collected.

(2). Payment received for contracts, separated into the agreement types Rental and Retail. For retail this includes revenue for paid in full sales as well as revenue for any financed sales.

(3). GRP... Total of damage waiver charges paid for each agreement type. The initials used for damage waiver can be set in your store setup, common ones are GRP, DWF, LDW.

(4). Total of club charges paid for each agreement type. For retail the club column is for interest income.

(5). Total of other charges paid for each agreement type. Other charges include delivery, processing, late fees and NSF fees.

(6). Total of taxes paid for each agreement type.

(7). Total payment received for each agreement type. This is the total of all the other columns combined.

(8). Grand total of all monies received. Note this does not always equal the total of revenue listed above, customer deposit paid(which is listed further down on the report) is money in your drawer, but it is not revenue so is not added in total revenue. Deposit spent becomes revenue but is not included in the total money received since it was not paid today, it is simply moving from customers deposit account to revenue.

(9). Amount of Bonus Bucks earned and spent. For more info about bonus bucks see the help topic here.

(10). Amount of Early Payoff money received (0 in this sample report) and the total rental minus EPO amount. This is useful if you want to break out EPO revenue from regular rental income.

(11). Amount of Petty Cash Payouts loaded, total deposits saved, and shortage. The report will always show a shortage if the End of Day Report has not been run and bank deposits have not been entered yet.

(12). Projected rental income compared to the actual rental income received, and the percent of projected rental collected. Projected rental income is the total rental payment, not including any other charges for agreements due TODAY.

(13). Number of Rental contracts opened and closed TODAY.

(14). Number of inventory items listed as BOR that were opened and closed TODAY.

(15). Number of Rental customers that were opened or closed TODAY.

(16). The cash price for any opened Rental contracts.

(17). Full contract amount for rental contracts opened and closed TODAY.

(18). Inventory cost, cost of inventory on all agreements opened and closed TODAY.

(19). Income received to date for the rental agreements opened and closed TODAY.

(20). Amount of profit earned. For opened contract this is contract amount - cost, for closed contracts this is income received to date - cost.

(21). Turns is the contract amount divided by cost, it is how many times cost you will collect if the contract goes to full term.

(22). Gain row: Amount of gain (or loss) on Rental contracts, BOR items, contract amount and inventory cost. This is opened amounts minus the closed amounts.

(23). Total of rent paid and other charges, average down payment for selected dates of report, and total rent paid to date.

(24). Count of opened Rental contracts according to term agreement type.

(25). Number of Retail contracts.

(26). Total sale amount for Retail contracts.

(27). Inventory cost for Retail contracts.

(28). Rental income received to date for all inventory on this sale.

(29). Amount of profit earned (sale amount - cost).

(30). Inventory cost divided by Sale Amount.

(31). Total of accounts, amount of overdue accounts from that total, and what percentage of total accounts are past due.

(32). Total of contracts, amount of overdue contracts from that total, and what percentage of total contracts are past due.

(33). Total of items on BOR list, amount of overdue items from that total, and what percentage of total BOR items are past due.

(34). Revenue comparison - month to date and last month to date.

(35). Revenue comparison - month to date and previous year month to date.

(36). Revenue comparison - year to date and last year to date.